rhode island income tax return

Form RI-1040ES - Estimated Individual Income. Qualifying widow er RI 1040 H Only.

Filing Rhode Island State Taxes What To Know Credit Karma

Check the status of your state tax refund.

. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can. Rhode Island residents now have until July 15 2020 to file their state returns and pay any state. More about the Rhode Island Form RI-1040NR Instructions.

RI 1040 H Only. Sign Mail Form RI-1040 or RI-1040-NR to. The amount of your expected refund rounded to the nearest dollar.

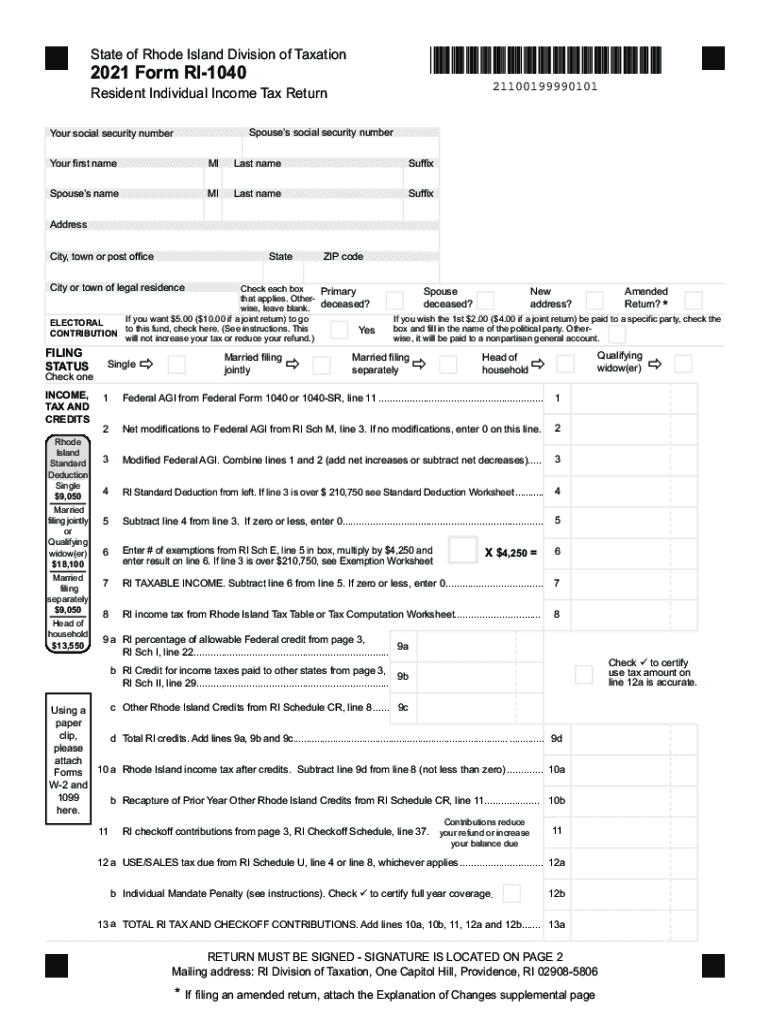

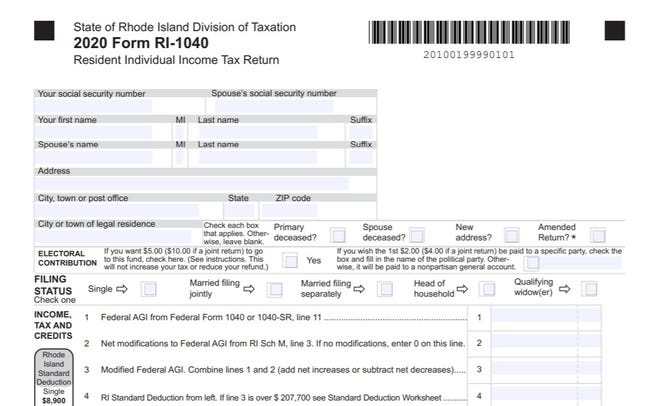

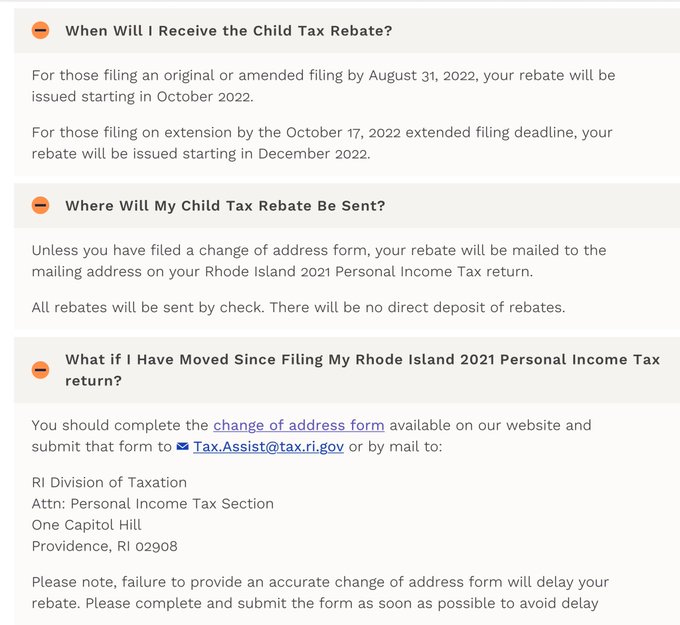

RI-1040 can be eFiled or a paper copy can be filed via mail. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. More about the Rhode Island Form RI-1040NR Instructions Individual Income Tax TY 2021 We last updated the Nonresident Income Tax Return Instructions in January 2022 so this is the.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by. The Rhode Island Division of Taxation has set three tax rates where youll pay different. And you are not enclosing a payment then use this address.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. Form RI-1040 is the general income tax return for Rhode Island residents. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

What do Ashley Kalus tax returns show. For 2019 state taxes the state has extended the filing and payment deadline. Unlike some other states the tax rates in Rhode Island dont vary by your filing status.

They show Kalus paying 192012 in federal income taxes and 40128 in state taxes to Rhode Island on 703729 in RI taxable. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. And you are enclosing a payment then use this address.

Download Complete Form RI-1040 residents or RI-1040-NR nonresidents and part-year residents for the appropriate Tax Year below. And you are filing a Form. If you live in Rhode Island.

The amount of your expected refund rounded. For example if your expected refund is between. You filed your tax return now - Wheres My Refund.

The table below shows the income tax rates in Rhode. Rhode Island resident income tax returns every year from tax year 2007 through tax year 2011 and had less than 200000 of reported federal AGI on their tax year 2007 Rhode Island. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

Details on how to only. Rhode Island State Income Taxes for Tax Year 2021 January 1 - Dec. We last updated Rhode Island Form RI-1040NR Instructions in January 2022 from the Rhode Island Division of Taxation.

How Do State And Local Property Taxes Work Tax Policy Center

2021 Form Ri Dot Ri 1040x Nr Fill Online Printable Fillable Blank Pdffiller

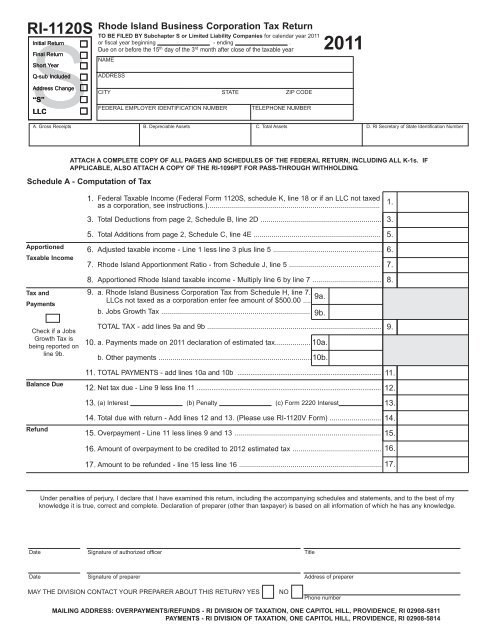

Ri 1120s Rhode Island Business Corporation Tax Return

Ri 1040c Rhode Island Composite Income Tax Return

Here S How Often Rhode Island Residents Get Audited Coventry Ri Patch

Rhodeislandtax Rhodeislandtax Twitter

Filing Rhode Island State Taxes What To Know Credit Karma

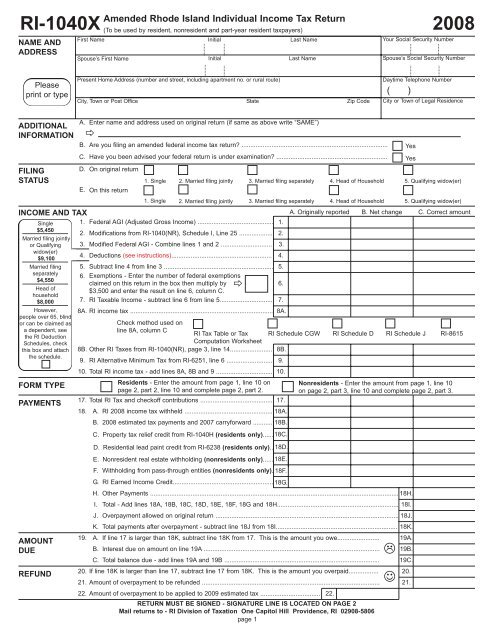

Ri 1040x 2008 Amended Rhode Island Individual Income Tax Return

Form 1040 Resident Resident Return Only

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Rhode Island Section 965 Income Is Not Deferrable For State Tax Purposes Salt Shaker

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

Tax Rebate Who Applies For An Automatic Return Of Up To 750 And When Will They Arrive Marca

Fillable Online Tax Ri Rhode Island Tax Exempt Form Fax Email Print Pdffiller

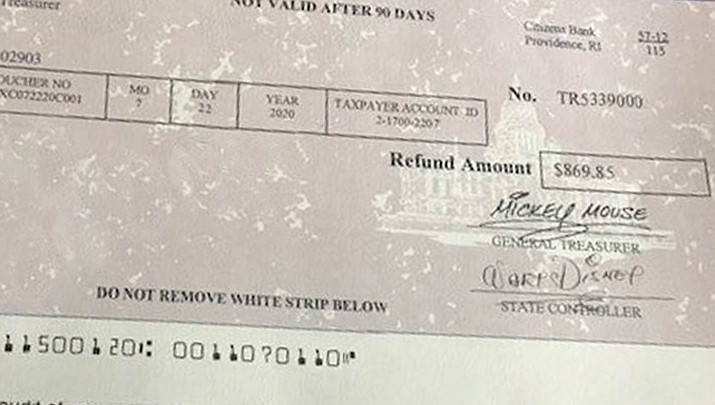

Ri Issues Tax Refunds Signed By Walt Disney Mickey Mouse The Daily Courier Prescott Az

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

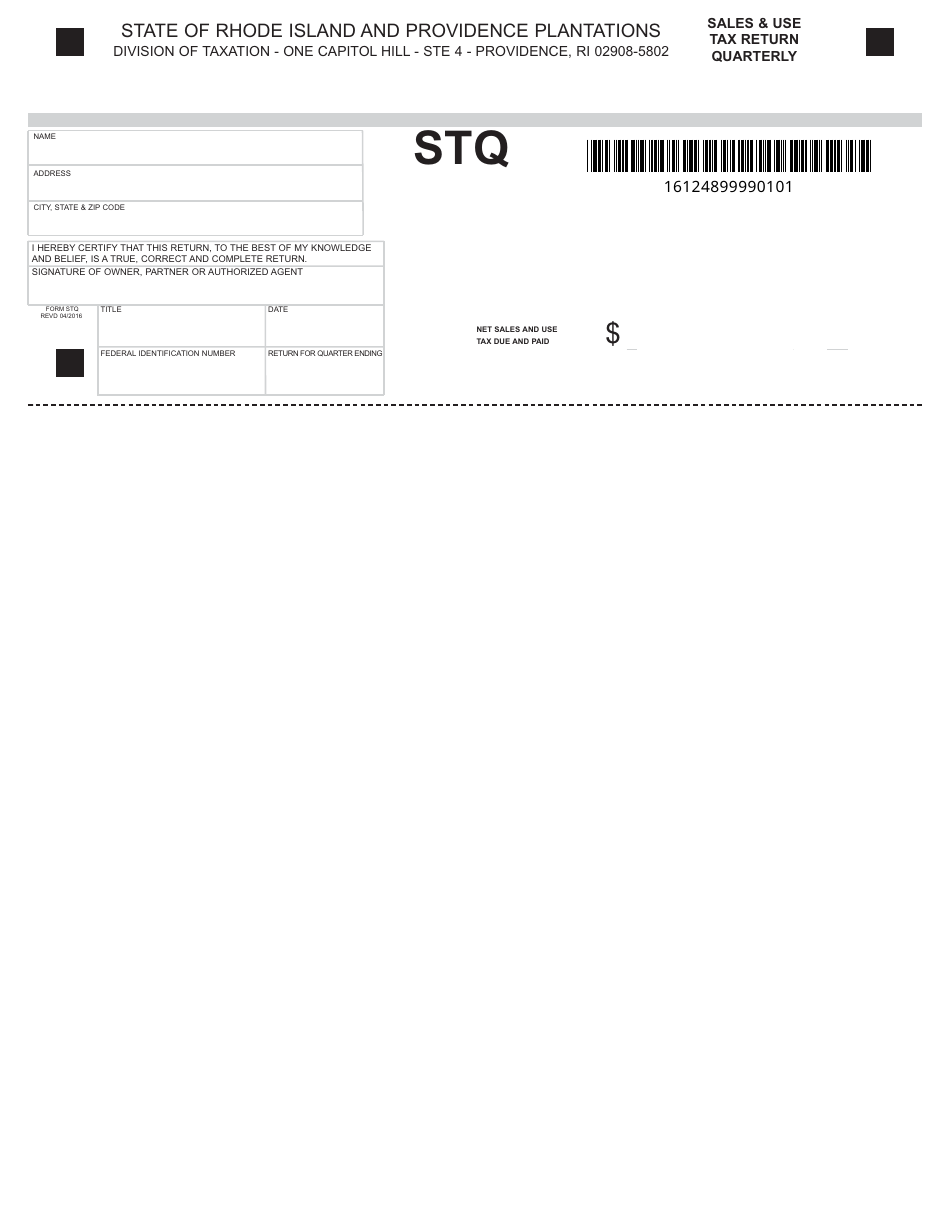

Form Stq Download Fillable Pdf Or Fill Online Sales Use Tax Return Quarterly Rhode Island Templateroller

Rhode Island State Tax Software Preparation And E File On Freetaxusa